Electrified cars: the xEV decade

Continents drifting ?

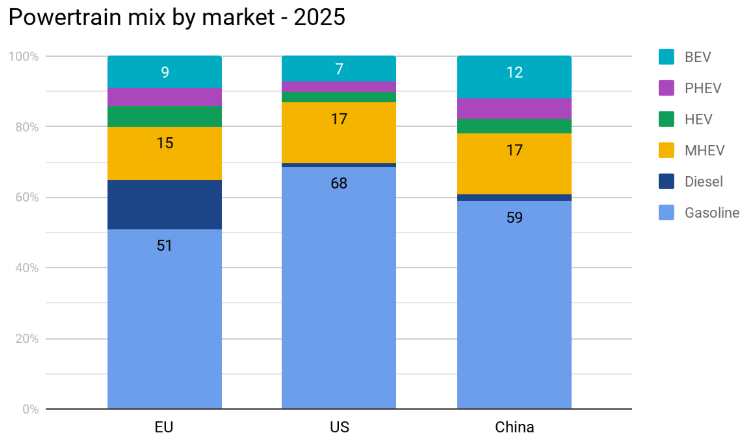

Are the three main auto markets, China, Europe and the US, drifting in different directions underneath these global numbers ? According to the BCG model, differences are expected, but they are not fundamental.

For instance, market share of BEVs is not expected to be significantly different in 2025 and 2030, in spite of contrasted government incentives.

| BEV Share | 2025 | 2030 |

| Europe | 9% | 25% |

| US | 7% | 21% |

| China | 12% | 26% |

The 2025 powertrain mix projection shows limited differences between regions, except for the diesel situation in Europe qui can be considered to be a variant of gasoline. Give or take a few percents, BCG projections are quite homogenous.

Working assumptions

What are these models built on ? The BCG study lists underlines a few interesting elements:

1) Short term, regulatory pressure in Europe and China accelerates electrification while the US lag behind

2) In the second half of the decade, total cost of ownership (TCO, purchase + energy) becomes a driving factor for adoption

3) Battery cost reductions is a key factor: BCG now forecasts 100$/kWh in 2030, versus 126$/kWh in their prior study, 2 years ago.

These last two points raise legitimate questions.

The revised BCG battery cost assumptions remain more conservative than other analysts, such as Bloomberg New Energy Finance who predict 89$/kWh in 2025 and 62$/kWh in 2030. The discrepancy is enormous and affects the most expensive component in an electric car.

Then, any TCO consideration has to be checked against fiscal aspects, and revenues derived from taxes on fossil fuels. In Europe in particular, states finance transport infrastructure by levying taxes on energy. A transfer from the gas pump to the electric socket will inevitably require a refactoring of the tax structure on the use of automobiles. An increasingly electrified fleet (with an increasing weight) will have to generate the same tax revenues as today’s largely combustion fleet, thereby eating into a TCO advantage largely based on untaxed energy (electricity from the grid).

Mobility pricing is seen as the only way to address chronic congestion at peak hours. To have the expected effect on road congestion, different powertrains will have to be treated in equivalent ways.

Finally, one would expect that large scale deployment of renewable electricity production sources, and the associated large scale energy storage infrastructure, will have a detrimental impact on electricity prices. Nuclear and coal/natural gas production are widespread incumbents because they provide a cheaper supply bedrock.

What about battery supply ?

If one assumes BEVs at a 50 kWh average, PHEVs at 15 kWh, HEVs at 1.5 kWh and MHEV at 0.5 kWh, BCG projections translate into a worldwide demand of 459 GWh in Lithium Ion cells for 2025.

SNE Research projects total installed Lithium Ion production capacity at 2025 à 1000 GWh. Cell production capacity should therefore not be a bottleneck.

Supply of raw materials, such as lithium, nickel, cobalt or copper, is more complex to analyze, furthermore as cell chemistry can vary between cell suppliers and, sometimes, car makers.