On en parle ...

Re: On en parle ...

Message par vravolta » 11 oct. 2023 08:17

Et une manière élégante de le faire est de laisser courir l'inflation: officiellement, l'état ne prélève rien, mais en pratique, tous les épargnants perdent et les endettés, comme l'état par exemple, gagnent. Seul hic, il faut que la BCE soit d'accord de ne plus jouer son rôle et d'apparaitre comme n'étant plus indépendante.

- _nicolas

- Membre V8

- Messages : 12677

- Inscription : 12 sept. 2005 18:05

- Véhicules : Macan S/Ex-997.1/997.2 S/991.1 S/991.1 C4 GTS

- Localisation : La Côte

Re: On en parle ...

Message par _nicolas » 01 nov. 2023 21:03

”Simplicity is the keynote of all true elegance” - Coco Chanel

- Tom63

- Membre V8

- Messages : 5956

- Inscription : 22 oct. 2008 15:45

- Localisation : Entre Paris et les volcans

Re: On en parle ...

Message par Tom63 » 02 nov. 2023 07:58

Finalement, le départ d'AN n'aura pas sauvé grand chose.

“When you see the tree you're about to hit, it's called understeer. When you can only hear and feel it, it's oversteer”

Walter Rohrl

- Tom63

- Membre V8

- Messages : 5956

- Inscription : 22 oct. 2008 15:45

- Localisation : Entre Paris et les volcans

Re: On en parle ...

Message par Tom63 » 02 nov. 2023 09:35

Je l'avais vu en France car Canal+ a maintenant un accord avec Apple...

“When you see the tree you're about to hit, it's called understeer. When you can only hear and feel it, it's oversteer”

Walter Rohrl

- ze_shark

- Site Admin

- Messages : 43087

- Inscription : 05 août 2005 22:54

- Véhicules : Audi RS6, 997 GT3, 355 GTS F1, 550M, 225xe

- Localisation : Star Alliance & Starwood Inc

- Contact :

SBF

Message par ze_shark » 03 nov. 2023 02:02

https://www.nytimes.com/live/2023/11/02 ... =url-share

Sale temps pour les fraudeurs. Il reste deux candidats de choix, cependant.Sam Bankman-Fried, the tousle-haired mogul who founded the FTX cryptocurrency exchange, was convicted on Thursday of all seven charges of fraud and conspiracy after a monthlong trial that laid bare the hubris and risk-taking across the crypto industry. These charges carry a maximum sentence of 110 years.

Mr. Bankman-Fried’s sentencing is set for March 28.

- ze_shark

- Site Admin

- Messages : 43087

- Inscription : 05 août 2005 22:54

- Véhicules : Audi RS6, 997 GT3, 355 GTS F1, 550M, 225xe

- Localisation : Star Alliance & Starwood Inc

- Contact :

WeGrift

Message par ze_shark » 11 nov. 2023 06:02

Here are three ways to become a billionaire. One is you create some good or service, you sell it for more than it costs you to produce it, and you keep doing that until you have a billion dollars. Call this a cash billionaire.

Another is you create some good or service, you sell it for more than it costs you to produce it, and you keep doing that until you are making, like, $100 million a year. Then you do a discounted cash flow analysis and say “well, it’s $100 million a year, figure it grows at 8% per year for the next 20 years, discount that back to today at a 15% discount rate and you get a present value of more than a billion dollars.” You own a stream of future cash flows worth $1 billion, which makes you a billionaire. This is a fairly common way for a business owner to become a billionaire; it has also become possible for celebrities, and we have talked about it in relation to Ye (Kanye West) and Taylor Swift. Call this a discounted cash flow billionaire.

If you are that sort of billionaire, you can probably convert it into cash, or some of it anyway. You can take your company public and sell your stock; you can sell your music catalogue to a private equity firm. You don’t have to: Bloomberg has anointed Taylor Swift a billionaire without her selling her catalogue (or having a billion dollars). But if you don’t convert to cash, your billionaire status is at risk. Those recurring cash flows are not certain in all future states of the world. Ye’s stream of nine-digit cash flows was abruptly cut off due to bad tweets, so he stopped being a billionaire. It’s not that he had a billion dollars in the bank and someone took it away from him; it’s that he had expected future cash flows worth a billion dollars, and then expectations changed. Sam Bankman-Fried was worth tens of billions of dollars due to the large and growing cash flows of the crypto exchange he owned, and then he wasn’t.

This shades into the third way to become a billionaire. Call it a probabilistic billionaire.

You create some company that does a thing, or hopes to, and even before it makes any money you say, well, this company has a 1% chance of being worth $1 trillion, so its expected value, today, is $10 billion. Anyone can say that — you can say “I have a 1% chance of discovering teleportation, which is probably a $1 trillion business, so I’m worth $10 billion today” — but that won’t get you on anyone’s list of billionaires.

On the other hand if you convince someone else that you have a 1% chance at doing a trillion-dollar thing, and that person has a lot of money, and she gives you $1 billion for a 10% stake in your company, then you really are a billionaire. Because you have a billion dollars in the bank. But that is not a strict requirement: If she gives you $100 million for a 1% stake in your company, you have $100 million in the bank, but also a mark-to-market valuation that says your remaining 99% stake is worth $9.9 billion. That might get you on a list of billionaires. If you sell five 1% stakes to reputable venture capital firms for $100 million each, you’re almost certainly on all the lists.[3]

Of course eventually you will either succeed (with 1% probability) or fail (99%) at creating a trillion-dollar company. If time goes by and you do not discover teleportation and you get bored and go back to your day job, then (let us assume) your probability of making $1 trillion goes to zero, and you are no longer a billionaire. Unless you already converted some of your stake to cash. If you convinced someone to give you a billion dollars for a 10% stake in your company with a 1% chance at a trillion-dollar idea, and then the company goes to zero, then:

You have a billion dollars, and She has lost a billion dollars. That’s it. The trillion dollars is gone, though it was never there; the true ex ante odds of you making a trillion dollars are essentially unknowable, but the ex post result is that you didn’t. But you thought about it, and your billion-dollar backer thought about it, and your shared belief led to a transfer of $1 billion from her bank account to your bank account, and that is the only thing that has happened in objective reality. The teleportation never happened, the trillion-dollar company never happened, but she really did write you that check and you really did cash it.

Anyway here’s Bloomberg's Tom Maloney on Adam Neumann:

We have discussed this before. My view is: Oh yes! Adam Neumann really did figure out how to make money. He figured out maybe the best and funniest way anyone has ever made money in the history of capitalism, which is “act crazy around Masayoshi Son until money spews out of him.” Figuring out how to rent out office space for more than you pay for it has absolutely nothing to do with it.WeWork Inc. never figured out how to make money. Adam Neumann sure did.

The office-leasing business declared bankruptcy this week, two years after finally going public minus its infamous co-founder. It has $19 billion of liabilities and $15 billion of assets. Longtime investors, including Softbank Group Corp. and the Vision Fund, will add to the enormous losses they’ve already taken on the venture.

“It has been challenging for me to watch from the sidelines as WeWork has failed to take advantage of a product that is more relevant today than ever before,” Neumann, 44, said in a statement.

But a part of Neumann might be thankful he was forced out in 2019 following the company’s disastrous first attempt at an initial public offering. While battering his reputation, the exit left him with plenty of liquidity, and he’s still worth $1.7 billion, according to the Bloomberg Billionaires Index.

At the Wall Street Journal, Eliot Brown reports:

YOU THINK? Imagine if he didn’t! Imagine if he walked into SoftBank’s offices and was like “hey I know that I don’t technically owe you any money, but you’ve had a rough time lately and I’m doing pretty well for myself, so here’s a few hundred million dollars just as a gift from me to you.” Has anything remotely like that ever happened in the whole history of WeWork? No, no, only the reverse has happened: SoftBank has given Neumann gobs of money for no obvious reason, over and over again, including this sweet loan. Now he has the choice to pay back a nine-digit loan with either (1) actual money or (2) shares of a bankrupt company. He would be crazy to pay with money. And not crazy in way that impressed Masayoshi Son all those years ago. Bad crazy.Now, with WeWork in bankruptcy and his remaining shares near worthless, there is a potential for further financial gain for Neumann worth hundreds of millions of dollars.

In late 2019, SoftBank committed billions of dollars to bail out WeWork after the office company’s failed attempt at an initial public offering left it low on cash and heavy on losses. Neumann was ousted by the company’s board, but before he surrendered control of the company he founded, Neumann negotiated significant concessions and payments from SoftBank.

One concession was a roughly $430 million loan from SoftBank to Neumann that had a key feature: Neumann wasn’t personally on the hook for paying it back. Instead, if he stopped paying, SoftBank would be able to seize his shares in WeWork as collateral.

The value of that collateral has plummeted. With WeWork’s stock price near zero, Neumann’s WeWork shares are currently worth $4 million, down from around $500 million in fall 2021, according to FactSet. SoftBank executives worry that Neumann may elect to simply walk away with the money he was lent and hand over the shares, people familiar with the situation said.

By the way, I would not really describe this transaction as, like, “SoftBank loaned Neumann some money and now they worry that he’s not gonna pay them back.” I would analyze this transaction more as “SoftBank bought $430 million of stock from Neumann when they kicked him out, but with some schmuck insurance on both sides”:

It looks bad, for WeWork (and its owner SoftBank), to have its founder dump all that stock on his way out the door, so if you call it a loan you save a bit of face. You can say that Neumann is still a big shareholder, even though he has gotten cash for his shares.

If somehow WeWork instantly recovered from the failed IPO debacle and became a $90 billion company, Neumann would be pretty bummed about selling at the bottom.

So you do it as a loan payable in stock: Neumann technically still owns the stock, he gets cash for it up front, if the company craters he keeps the cash, but if the company soars he keeps the stock. It’s a big cash payoff plus some stock options. The options turned out to be worthless, but the cash is still good.

- ze_shark

- Site Admin

- Messages : 43087

- Inscription : 05 août 2005 22:54

- Véhicules : Audi RS6, 997 GT3, 355 GTS F1, 550M, 225xe

- Localisation : Star Alliance & Starwood Inc

- Contact :

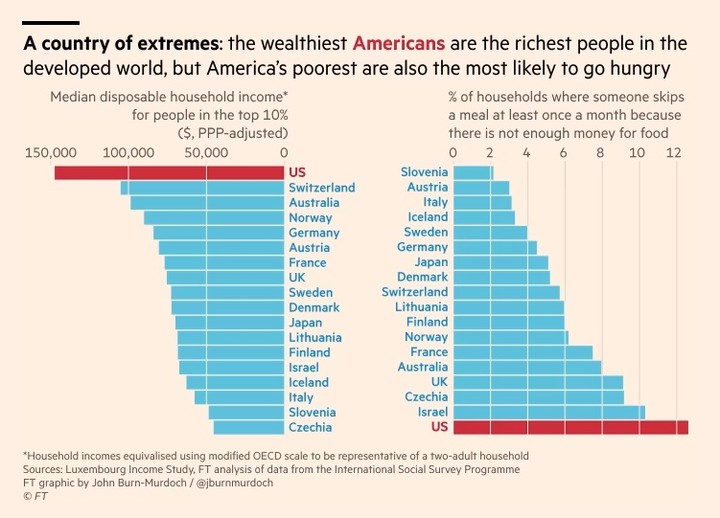

Pauvreté en Suisse

Message par ze_shark » 09 déc. 2023 03:37

6% des foyers qui n'ont pa assez à bouffer au moins une fois par mois.

Re: On en parle ...

Message par rbk » 09 déc. 2023 10:55

- _nicolas

- Membre V8

- Messages : 12677

- Inscription : 12 sept. 2005 18:05

- Véhicules : Macan S/Ex-997.1/997.2 S/991.1 S/991.1 C4 GTS

- Localisation : La Côte

Re: On en parle ...

Message par _nicolas » 09 déc. 2023 12:21

”Simplicity is the keynote of all true elegance” - Coco Chanel

- _nicolas

- Membre V8

- Messages : 12677

- Inscription : 12 sept. 2005 18:05

- Véhicules : Macan S/Ex-997.1/997.2 S/991.1 S/991.1 C4 GTS

- Localisation : La Côte

Re: On en parle ...

Message par _nicolas » 09 déc. 2023 19:10

”Simplicity is the keynote of all true elegance” - Coco Chanel

Re: On en parle ...

Message par rbk » 09 déc. 2023 20:29

- Nagata-San

- F1

- Messages : 5880

- Inscription : 07 oct. 2008 12:06

- Véhicules : Un de chaque énergie.

- Localisation : CH

- Contact :

Re: On en parle ...

Message par Nagata-San » 11 déc. 2023 11:21

Dans la plupart des cas, ce sont des erreurs de gestion, de petites conneries accumulées (genre 84 chf d'app store abos tacites par mois, les clopes, netflix etc, à des leasings débiles, ou encore des appart surchargés de bibelots et futilités, voir des soirées alcools et drogues), à des noyés des cartes de crédits, ou ceux qui ont passé le cap "2 pages de poursuites c'est pas si grave".

La grande nuance, c'est l'effort fourni pour surmonter. Y'a 7-10 ans je voyais les gens "moins motivés" plonger dans ces soucis, aujourd'hui je vois aussi des gens qui travaillent très dur et qui peinent et souvent des jeunes, et des retraités. Loyers, charges, caisses maladies, crèches, impôts, l'étau s'est durement resserré sur une partie de la population.

Et le service à la soupe populaire, je n'y voyais que des drogués, de nos jours, j'y trouve des étudiants, des papas divorcés, des papys et des immigrés broyés par le système.

Pas encourageant quant au futur.

- _nicolas

- Membre V8

- Messages : 12677

- Inscription : 12 sept. 2005 18:05

- Véhicules : Macan S/Ex-997.1/997.2 S/991.1 S/991.1 C4 GTS

- Localisation : La Côte

Re: On en parle ...

Message par _nicolas » 07 janv. 2024 08:10

”Simplicity is the keynote of all true elegance” - Coco Chanel

Revenir vers « Culture, économie, arts de vivre & politique »

- Charte et annonces

- ↳ Charte et annonces

- Asphalte.ch Auto

- ↳ Citadines & Compactes

- ↳ Monospaces & SUVs

- ↳ Coupés & berlines

- ↳ Roadsters & cabriolets

- ↳ GTs

- ↳ Supercars

- ↳ Sujets auto généraux

- ↳ Tuning & Technique

- ↳ Sorties, balades, journées circuit

- ↳ Sport (F1, WEC, etc ...)

- ↳ Accessoires, produits & services

- ↳ Anciennes

- ↳ Présentation / membres

- ↳ Petites Annonces

- ↳ English, Deutsch anche Italiano

- Hors Autos

- ↳ Asphalte Moto

- ↳ Matos

- ↳ Culture, économie, arts de vivre & politique

- ↳ Autres sujets hors sujet

- Membres V8

- ↳ V8 - Sujets autos

- ↳ V8 - Sujets généraux

- ↳ V8 - Sorties

Qui est en ligne ?

Utilisateurs parcourant ce forum : Aucun utilisateur inscrit et 139 invités

Connexion

Les articles les plus lus

- Le fuseau horaire est réglé sur UTC+01:00

- Haut

- Supprimer tous les cookies du forum